Artificial Intelligence / AI / AI in Finance / AI Finance

Table of Contents

Introduction

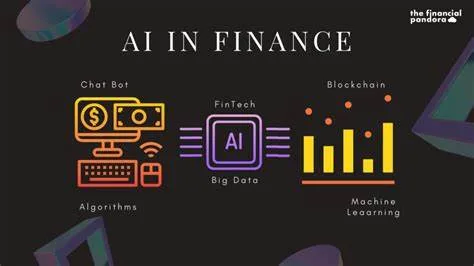

The financial industry has long been at the forefront of adopting cutting-edge technologies to optimize its operations, and Artificial Intelligence (AI) is no exception. Over the past decade, AI has played a pivotal role in reshaping the financial sector. From automating repetitive tasks to identifying fraudulent activities, AI has emerged as a game-changer in the world of finance. In this blog, we will explore the various AI applications in finance, including fraud detection, algorithmic trading, risk assessment, and customer service enhancements. Furthermore, we will delve into the potential benefits and challenges of implementing these AI technologies.

Fraud Detection

Maintaining the security and integrity of transactions is of utmost importance in the financial domain. Fraud detection is an area where AI has significantly contributed. AI-powered algorithms can analyze vast volumes of data, identify patterns, and detect anomalies that may indicate fraudulent activity. Machine learning models learn from historical fraud cases and continuously improve their accuracy in detecting new forms of fraud.

The adoption of AI in fraud detection enables financial institutions to minimize losses, safeguard customer assets, and maintain trust with their clients. Additionally, AI-driven fraud detection systems significantly reduce the time taken to identify and address potential threats, enabling real-time responses to emerging risks.

Algorithmic Trading

AI has revolutionized trading, with algorithmic trading gaining popularity among financial institutions and individual investors. AI-powered trading algorithms can process vast amounts of financial data, analyze market trends, and execute trades at lightning speed, surpassing human traders’ capabilities.

The advantage of algorithmic trading lies in its ability to remove human emotions from the decision-making process, leading to more rational and data-driven investment choices. Furthermore, AI algorithms can identify arbitrage opportunities and predict market movements, optimizing investment strategies and potentially increasing returns.

However, it is essential to note that algorithmic trading also poses risks. Rapid and automated trading can lead to market volatility and may result in flash crashes if not properly controlled and monitored.

Risk Assessment

Accurate risk assessment is critical in the financial sector. AI has proven to be a valuable tool in analyzing complex data sets and generating insights that assist in risk assessment and management. Machine learning models can predict credit defaults, assess investment risks, and evaluate market fluctuations.

AI-driven risk assessment models provide financial institutions with more comprehensive and nuanced risk profiles of their clients, enabling them to make more informed decisions regarding lending, investments, and other financial transactions. This technology also helps identify potential fraudsters or high-risk customers, contributing to a safer and more secure financial environment.

Customer Service Enhancements

Exceptional customer service sets financial institutions apart from their competitors. AI has made significant advancements in improving customer interactions through chatbots and virtual assistants. These AI-driven customer service solutions can handle routine inquiries, provide personalized recommendations, and promptly resolve simple issues.

By freeing up human agents from repetitive tasks, financial institutions can allocate their resources more effectively and focus on addressing more complex and high-value customer needs. AI-powered customer service operates 24/7, ensuring that clients receive assistance whenever they require it, regardless of time zones or working hours.

Challenges and Future Prospects

Although the integration of AI in finance offers numerous advantages, it also presents challenges. Data privacy and security are paramount concerns, given the sensitive nature of financial information. Financial institutions must prioritize compliance with regulations and ensure that AI models are transparent, explainable, and free from biases.

Furthermore, effective AI implementation requires substantial investments in infrastructure, talent, and ongoing maintenance. As AI continues to evolve, continuous learning and updating AI models become essential to stay relevant and competitive in the dynamic financial landscape.

AI in Personalized Financial Advice

AI plays a significant role in enhancing the quality and accessibility of personalized financial advice for individual investors. Through advanced algorithms, AI can analyze an individual’s financial situation, goals, risk tolerance, and investment preferences to offer tailored investment recommendations.

Robo-advisors, powered by AI, have gained popularity in recent years for their ability to provide cost-effective and automated investment advisory services. These platforms use AI-driven algorithms to manage portfolios, rebalance assets, and optimize investments based on changing market conditions. This democratization of financial advice has empowered individuals with limited financial knowledge to access professional investment guidance.

Moreover, AI-based financial planning tools can forecast the impact of different financial decisions and help individuals make informed choices about retirement planning, tax optimization, and other crucial financial aspects.

AI-Powered Credit Underwriting

In the lending industry, AI is transforming credit underwriting processes. Traditional credit scoring models often rely on limited data points, leading to incomplete risk assessments. AI, on the other hand, can analyze a broader range of data, including alternative data sources, to create more accurate and inclusive credit risk profiles.

By incorporating AI into credit underwriting, financial institutions can better evaluate borrowers’ creditworthiness and extend loans to underserved populations. This inclusivity enables more people to access credit, fostering economic growth and financial stability.

However, ensuring that AI models are free from bias and discriminatory practices is critical in promoting fair lending practices. Financial institutions must remain vigilant and continually audit their AI algorithms to eliminate any potential biases that might emerge in the data.

AI-Driven Compliance and Regulatory Reporting

Financial institutions face increasingly complex and stringent regulatory requirements. AI-powered solutions have proven invaluable in automating compliance processes and managing regulatory reporting obligations.

AI algorithms can analyze vast amounts of data to detect potential compliance violations and suspicious activities, ensuring timely identification and reporting to regulatory authorities. Automation of compliance tasks also reduces the risk of human errors and improves overall efficiency.

Moreover, as regulations evolve, AI can adapt to changes more rapidly than manual processes, helping financial institutions stay compliant in a dynamic regulatory landscape.

AI in Finance key facts

- AI detects financial fraud and safeguarding transactions.

- Algorithmic trading leverages AI for market insights.

- Risk assessment powered by AI enhances decision-making.

- Customer service improves with AI-driven solutions.

- AI enhances fraud prevention in financial systems.

- Algorithmic trading gains efficiency through AI integration.

- AI-driven risk assessment minimizes financial vulnerabilities.

- Customer service gets a boost from AI-powered tools.

- AI tackles fraud, ensuring secure financial operations.

- Finance embraces AI for advanced algorithmic trading.

Conclusion

The financial sector’s exploration of AI applications has revolutionized the industry, enabling financial institutions to optimize their operations, reduce risks, and enhance customer experiences. From fraud detection to algorithmic trading, risk assessment, customer service enhancements, personalized financial advice, credit underwriting, and compliance automation, AI’s potential impact is far-reaching.

However, the integration of AI in finance comes with responsibilities and challenges. Ensuring data privacy, maintaining transparency and explainability in AI models, and mitigating biases are crucial considerations. With responsible AI adoption, the financial sector can unlock new opportunities, create innovative solutions, and build a more resilient and inclusive financial ecosystem.

As AI continues to advance, collaboration between financial experts, technologists, and regulators is essential to strike the right balance between innovation and safeguarding the interests of customers and the broader financial system. Embracing AI with prudence will propel the financial sector into a future of greater efficiency, security, and accessibility, benefiting both financial institutions and their clients alike.

Read More: Artificial Intelligence / AI / AI in Finance / AI Finance